Financial resources are essential in order to live longer and better lives. Despite recovery in jobs, stock and real estate markets since the Great Recession, more Americans in the 21st century are struggling to achieve financial security. With longer life expectancies come more opportunities, but also more risks. As people add more years to their retirement, there is inadequate time to amass income and savings for a longer retirement. In the words of Stanford University Professor of Economics John Shoven, “Few workers can fund a 30-year retirement with a 40-year career.” This added pressure on finances makes it all the more critical that we maximize earnings, invest wisely and protect our assets from catastrophic events. The financial security index shown below summarizes nine metrics characterizing three key paths to financial well-being: healthy cash flow, asset investments and protection.

FINANCIAL SECURITY INDEX

[otw_shortcode_content_toggle title=”Included in the Index” opened=”closed” icon_type=”general foundicon-graph”]

1. Threshold income (200% of the federal poverty level)

2. Emergency resources (proportion who have access to 3000 dollars, all liquid sources)

3. Uncollaterized debt less than 20% of the household’s income

4. Homeownership

5. Retirement plan participation (individuals who live in households with an IRA and/or workplace-based retirement account)

6. Investments (proportion of individuals in households with any type of investment account)

7. Health insurance

8. Life Insurance

9. Long-term disability/care

[/otw_shortcode_content_toggle]

NOTABLE FINDINGS

- A 15-year decline in health insurance coverage among the least educated is reversing since implementation of the Affordable Care Act.

- Income levels of Millennials without any college education are often at or near poverty levels.

- Millennials with college degrees are 50% more likely to carry debt, which is 5 times higher on average than recent college grads 15 years ago.

- Only one in three Americans have any established retirement savings plans before age 55.

SPECIAL TOPIC:

FINANCIAL LITERACY AMONG LATINO AMERICANS

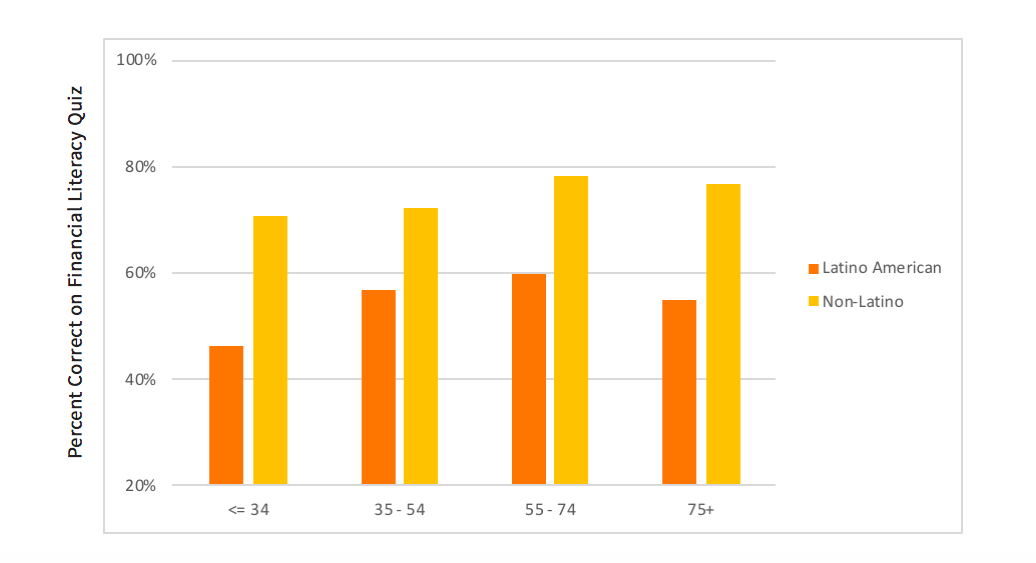

In 2016, the Stanford Center on Longevity (SCL) Sightlines project uncovered a large decrease in financial security among Latino American middle-aged adults, with 12 percent fewer being financially secure in 2014 versus in 2001— the largest decline of any other U.S. ethnic group. As discussed in a recent Wall Street Journal post by SCL advisory council member Sol Trujillo, addressing Latino financial security is critical to American longevity as Latinos are poised to comprise a large share of America’s future work force and are living longer than any other U.S. ethnic group.

Financial literacy lower for Latinos vs. the American population as a whole

A similar pattern emerged for the number of times respondents indicated “Don’t know” in response to each question, an answer that has been associated with lower levels of financial confidence. This is key because it may not be that Latino Americans are less knowledgeable, but rather that they are less comfortable answering these questions because they feel less financially confident. Because the association between “Don’t know” and financial confidence does not exactly overlap, other possible reasons, such as feeling threatened or anxious in a test-taking context or finding the topics of the questions to be irrelevant to their daily life, may be at play. In the future, we plan to delve deeper into these and other potential explanations for the lower financial literacy among Latino Americans. In doing so, we can better determine viable strategies for intervention among Latinos as they make a variety of financial decisions at all stages of life.