A New Year’s Resolution: Manage Debt

By Jialu Streeter

In a recent study by the Stanford Center on Longevity and the Global Financial Literacy Excellence Center (GFLEC) at the George Washington University, researchers showed that financial wellbeing could be assessed by three categories of questions: (1) how people manage debt and cash flow, (2) how they build wealth, and (3) their understanding of financial risks.

In a recent study by the Stanford Center on Longevity and the Global Financial Literacy Excellence Center (GFLEC) at the George Washington University, researchers showed that financial wellbeing could be assessed by three categories of questions: (1) how people manage debt and cash flow, (2) how they build wealth, and (3) their understanding of financial risks.

Indeed, debt management has become increasingly crucial in determining financial health. The level of debt held by all families in America has increased substantially over the last three decades. After considering inflation, the mean household debt has doubled even though the pre-tax household income has only increased by 30 percent.1

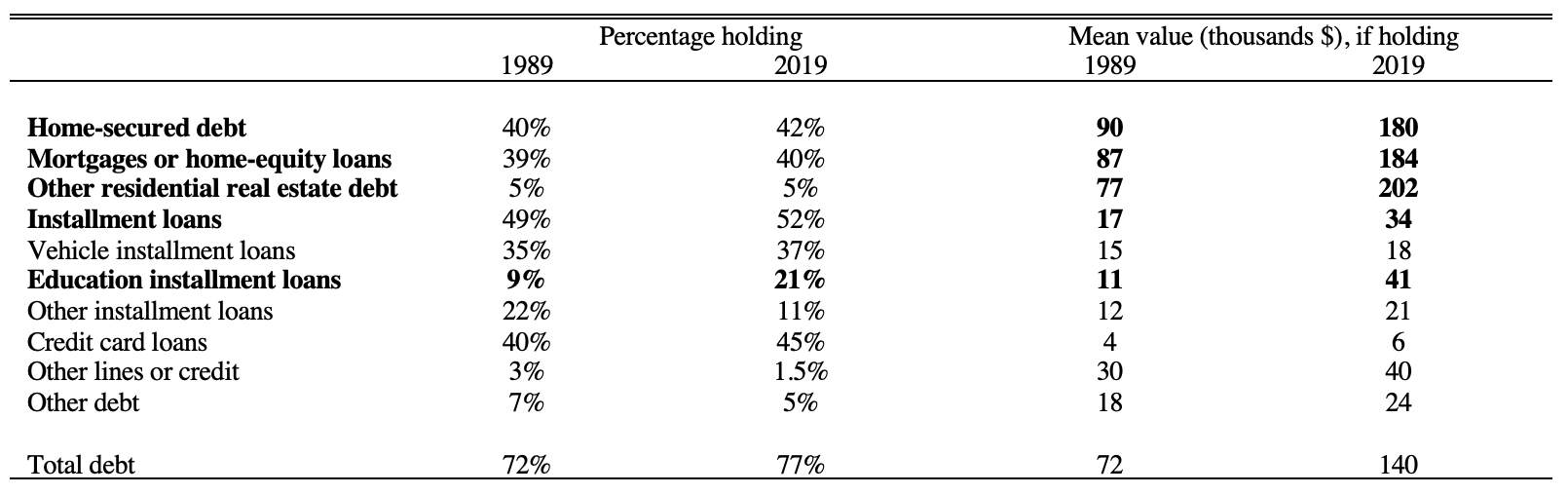

A decomposition of household debt shows that two types of debt have experienced the most significant surge: mortgages and student loans. While the percentage of households having home-related debt has stayed relatively stable over time, the value of such loans has more than doubled. Moreover, the expansion in student loans accounted for an even more substantial chunk in debt growth. Not only did the percentage of households holding education loans increase from 9% in 1989 to 21% in 2019, the average value of such loans nearly quadrupled ($11k to $41k).

Table 1: Debt holding and mean values. Federal Reserve Data.

The Stanford-GFLEC study found that the debt and cash flow vulnerability is especially acute among those between 30 and 44, non-Hispanic Blacks, and those with low income or unemployed. For example, half of the people aged 30-44 said they had too much debt, compared to 21% among people over age 60. In addition, about 45% of non-Hispanic Blacks had too much debt compared to 35% of non-Hispanic Whites.

The vulnerability in debt and cash flow is primarily driven by two factors: a mismatch between earnings and borrowing and the suboptimal uses of risky financial services. Well-educated, younger people can sometimes be burdened by student loans and mortgage debt that exceed their repayment ability. In 2019, student loan borrowers aged 30-44 had on average $42k outstanding student loans. To put things in context, a college graduate earns an average starting salary of $51k.2 The student loan burden has kept on rising. Between 2001 and 2019, outstanding student loan balances as a share of family income has increased from 30% to 48% among people owing student loans. In terms of mortgage debt, Millennials are less likely than Baby Boomers to own homes by age 30; however, when they do, their mortgage-income ratio is much higher than that of Baby Boomers at the same age.3

Another important yet often overlooked factor contributing to debt challenges is the lack of understanding of financial risks and the subsequent misuses of high-cost, risky financial services. For example, nearly 60% of Blacks and Hispanics said they had had expensive credit card use, and 42% of them have used alternative financial services such as payday loans. The inadequate knowledge of financial instruments is mainly caused by lower educational attainment, and more importantly, an alarmingly low level of financial literacy. For example, only 15% of Blacks and Hispanics in the data sample answered three basic financial literacy questions correctly, compared to 35% among the non-Black, non-Hispanic population.

What can we do to ensure that we manage our debt? We have the following suggestions.

First, learn as much as possible about housing and student loans before deciding to borrow. Project future earnings and assess what percentage of future income will pay for mortgages or student loans.

Second, set aside emergency funds to cover unexpected expenses and spend within one’s means. About 30% of surveyed individuals in the FINRA Foundation’s 2018 National Financial Capability Study said they could not come up with $2000 within a month to cover unexpected expenses. Close to half of the respondents said their savings were less than three months of their living expenses. Without a rainy-day fund, an adverse financial shock may push us to borrow, often at high costs.

Third, pay off credit card balances each month to avoid high interest payments. Surveys have shown that more than half of credit card users don’t pay off each month’s entire balance.4

Fourth, increase financial knowledge. Explore online resources such as www.finra.org/investors to learn how to set financial goals, manage spending and debt, invest and plan for the future, and protect one’s assets.

This research was supported by a grant from the FINRA Investor Education Foundation. All results, interpretations and conclusions expressed are those of the research team alone, and do not necessarily represent the views of the FINRA Investor Education Foundation or any of its affiliated companies.

1Federal Reserve Data. https://www.federalreserve.gov/econres/scf/dataviz/scf/chart/#series:Before_Tax_Income;demographic:all;population:1;units:mean;range:1989,2019

2NACE Salary Survey – Final Starting Salaries for Class of 2018 New College Graduates Data Reported by Colleges and Universities.

3https://longevity.stanford.edu/home-ownership/

4https://www.yahoo.com/now/44-pay-off-full-credit-122812212.html