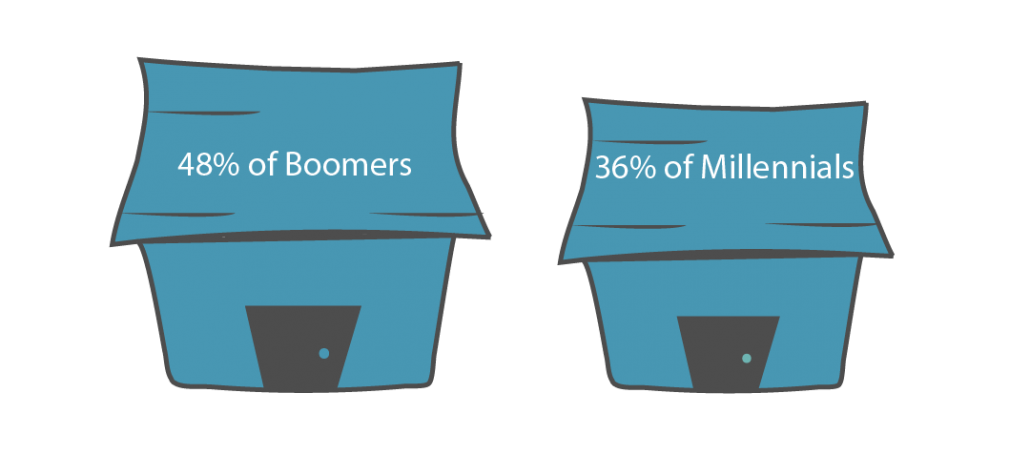

Percent of Boomers and Millennials who owned a home by age 30.

Owning a home is not only a cultural touchstone; it is closely linked to how Americans plan for their financial future. Surveys show that Americans of every generation continue to feel strongly about the desirability of homeownership, regardless of whether they have achieved it themselves. Nevertheless, by 2016, the rate of homeownership fell to a 50-year low. As part of the Milestones study by the Stanford Center on Longevity’s Sightlines Project, we investigate generational differences in in rates and predictors of current homeownership trends.

[content_tooltip id=”23005″ title=”Home Ownership Heat Map”]

Hover Over Map to Enlarge

EXPLORE THE DATA

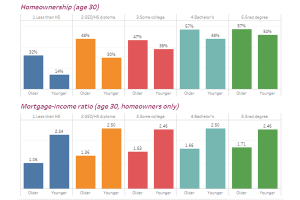

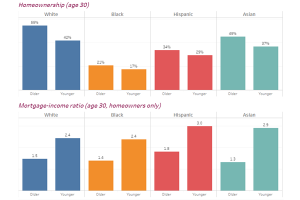

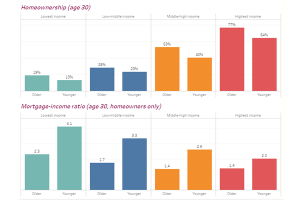

PERCENTAGE OF AMERICANS WHO ARE HOMEOWNERS

FACULTY SPOTLIGHT

SEPIDEH MODREK

Assistant Professor of Economics

San Francisco State University, College of Business

Dr. Modrek’s work examines the nexus of health, income, and wealth using econometric techniques. Her projects aim to elucidate how changes in social circumstance lead to changes in health.

Dr. Modrek’s work examines the nexus of health, income, and wealth using econometric techniques. Her projects aim to elucidate how changes in social circumstance lead to changes in health.

“The timing of marriage and childbearing are strongly related to homeownership and these life events are highly interrelated. As younger cohorts delay or forego marriage, these cultural and sociodemographic changes are also likely to have an effect on homeownership.”

To connect with our faculty affiliates, please contact SCL program manager, Nikki Tran ([email protected])