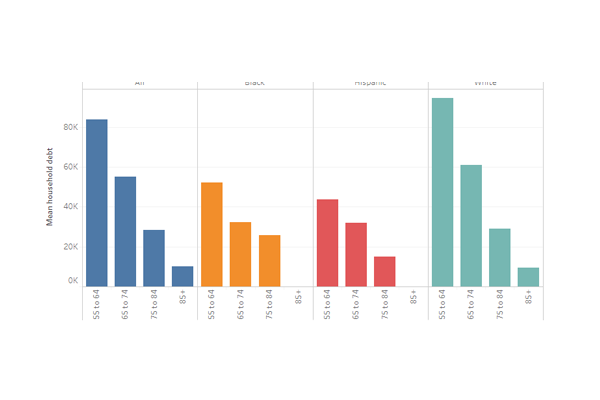

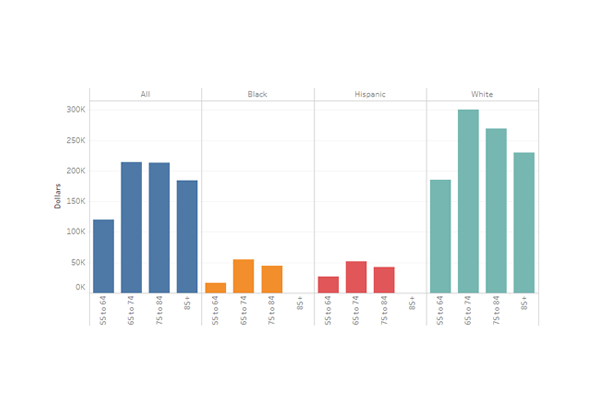

Debt-to-Wealth Ratios of Generations in the US. Larger percents indicate higher debt.

As Americans live longer, there is much debate in policy, financial, and academic circles about how best to prepare for retirement at all stages of life. While over half of Americans have a retirement account, are Americans saving enough especially as future generations are living longer than ever before? Given unprecedented levels of debt as they enter retirement, how are Baby Boomers faring compared to previous generations? Our most recent Sightlines analysis of retirement contributions calls for alternative models of achieving financial security through late life.

[content_tooltip id=”28257″]

Hover over map to enlarge

EXPLORE THE DATA

Click any image to enlarge.

PERCENT OF AMERICANS WITH RETIREMENT PLANS

SCL AFFILIATE SPOTLIGHT

DR. GOPI SHAH GODA

Deputy Director and Senior Fellow

Stanford Institute for Economic Policy Research

In addition to being the Deputy Director and a Senior Fellow of SIEPR, Professor Gopi Shah Goda is also a Faculty Research Fellow of the National Bureau of Economic Research. Her research involves investigating the economics of aging, including its relation to topics such as policy making and retirement. Her work also offers insight into caregiving and insurance, and investigates how these factors can affect all age groups. In her interview with the Center on Longevity, Dr. Gopi Shah Goda gives us her perspective on how retirement planning can affect anyone from millennials to those already taking advantage of their savings. Bio

In addition to being the Deputy Director and a Senior Fellow of SIEPR, Professor Gopi Shah Goda is also a Faculty Research Fellow of the National Bureau of Economic Research. Her research involves investigating the economics of aging, including its relation to topics such as policy making and retirement. Her work also offers insight into caregiving and insurance, and investigates how these factors can affect all age groups. In her interview with the Center on Longevity, Dr. Gopi Shah Goda gives us her perspective on how retirement planning can affect anyone from millennials to those already taking advantage of their savings. Bio

“The idea that you can support a 20-year retirement with 30 years of work is—is outdated. And can’t continue. It’s just not sustainable.”

“I think that there’s a lot of hope in terms of the way that we can potentially train younger individuals to think about saving in a more holistic way that could have impacts on saving for the future.”

To connect with our faculty affiliates, please contact SCL program manager, Nikki Tran ([email protected])